Protecting What You’ve Earned: Recognizing and Preventing Financial Exploitation

| Living as an Older Adult in PA

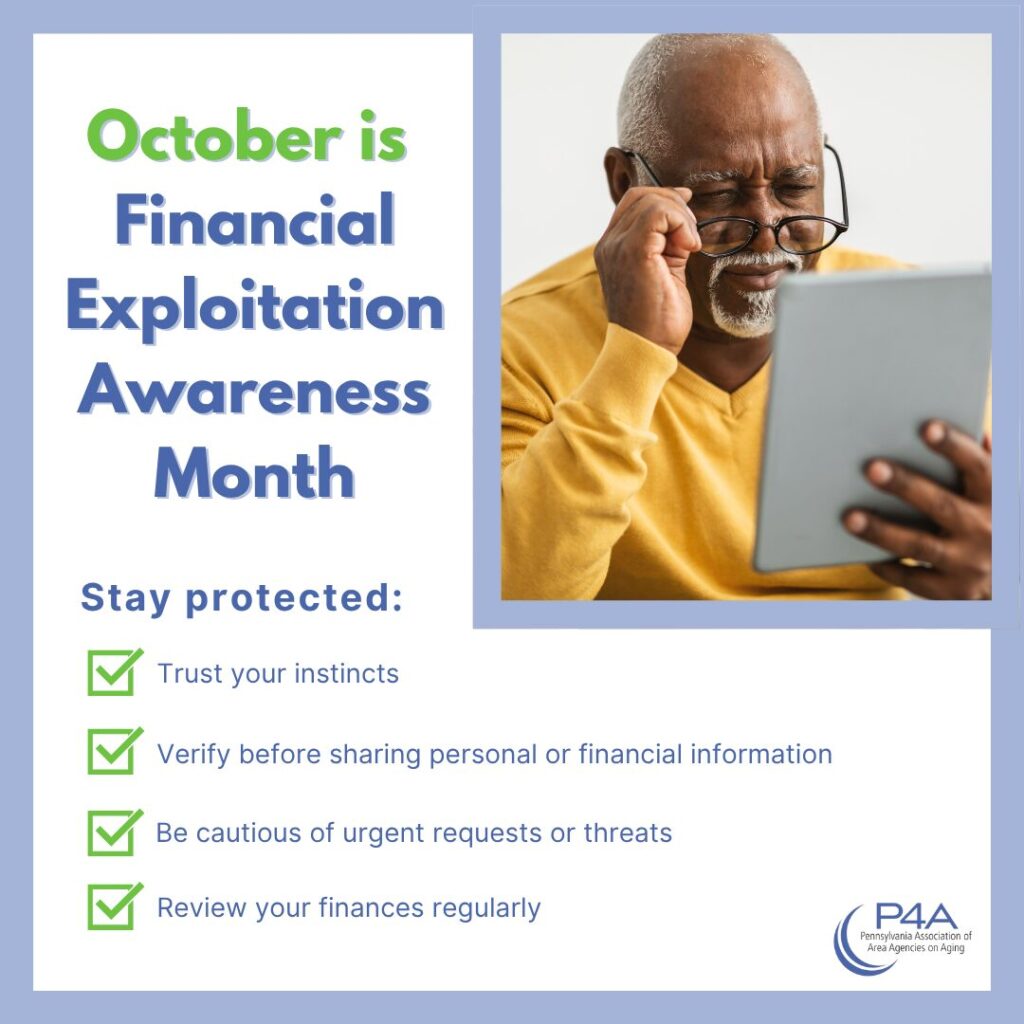

October is Financial Exploitation Awareness Month, a time to shine a light on an issue that affects thousands of older Pennsylvanians. Nationally, older adults over age 60 lose $28.3 billion a year to financial exploitation. [1] These aren't just numbers, they represent hard-earned savings, retirement funds, and financial security that too many older Pennsylvanians are losing to scammers and fraudsters.

Pennsylvania's Area Agencies on Aging are committed to protecting older adults from financial exploitation and ensuring they have the knowledge and resources to keep their finances safe.

Understanding Financial Exploitation

Financial exploitation can take many forms. It might be a stranger calling to say you've won a prize, a fake tech support representative demanding remote access to your computer, or even someone impersonating someone you know. Scammers are becoming increasingly sophisticated, using technology and psychological tactics to pressure older adults into giving away money or personal information.

The impact goes beyond dollars and cents. When older adults fall victim to financial exploitation, they often experience feelings of shame, embarrassment, and loss of independence. Many are hesitant to report what happened, which allows scammers to continue targeting others.

It Can Happen to Anyone: Joann's Story

Consider Joann, an older adult from Delaware County, who was recently scammed out of $12,000. Fraudsters targeted her with relentless calls and texts for weeks in an elaborate scheme designed to confuse and pressure her. Like many victims, Joann felt overwhelmed and uncertain about what to do.

Fortunately, her local Area Agency on Aging (AAA), quickly stepped in after learning about her situation. They connected Joann with advocates and vital resources to help her recover what she lost and protect her from further exploitation. This is exactly the kind of support local AAA’s are here to provide.

Seven Ways to Protect Yourself

- Trust Your Instincts: If something feels wrong, it probably is. Scammers are skilled at creating convincing stories, but gut feelings are powerful tools. Listen to that inner voice and pause to reconsider.

- Verify Before Trusting: When someone claims to be from a government agency, bank, or company, hang up and call the organization directly using a phone number found independently. Real representatives will understand the caution.

- Keep Information Private: Social Security numbers, bank account numbers, credit card details, and passwords should never be shared over the phone, through email, or via text message. Legitimate organizations already have this information and won't ask to confirm it through these methods.

- Be Wary of Urgent Demands: Scammers thrive on creating panic with claims of closed accounts, imminent arrest, or lost opportunities. Real emergencies don't happen over unsolicited phone calls or emails. Take time to wait, think, and consult with someone trusted.

- Protect Online Presence: Avoid opening emails or clicking links from unrecognized senders. Be cautious about sharing personal details on social media, as scammers use this information to guess passwords. Use unique, strong passwords and consider a password manager.

- Review Finances Consistently: Check bank statements, credit card bills, and investment accounts regularly for unrecognized charges. Set up automatic alerts for withdrawals, large purchases, or address changes. Request free annual credit reports to monitor for unauthorized accounts.

- Build a Support Network: Talk openly with family members or trusted friends about financial matters. Consider giving a trusted contact permission to receive notifications about unusual account activity for an extra layer of protection.

Support Is Available

Area Agencies on Aging throughout Pennsylvania are here to help. They offer resources, education, and support to help older adults stay safe from financial exploitation. Whether someone needs help understanding a suspicious contact, reporting fraud, or recovering from exploitation, assistance is available.

This Financial Exploitation Awareness Month, share this information with friends, family, and neighbors. The more informed communities are, the better protected everyone is.

To report elder abuse or exploitation, visit https://www.pa.gov/services/aging/report-abuse-of-an-older-adult.html.

Stat: https://states.aarp.org/colorado/aarp-report-28-3-billion-a-year-stolen-from-adults-60